This month's Auspice Blog is the full research article, previously summarized and featured in the April 7th, 2024 Financial Post (here), the March 2024 Auspice Blog (here), and an upcoming publication in the summer edition of the Commodity Insights Digest, a publication of Bayes Business School - City, University of London (U.K.).

To download the Auspice April 2024 Blog as a PDF, click here.

Like many things within financial markets, the link between commodities and the overall economy and global stock markets is a bit of a mystery.

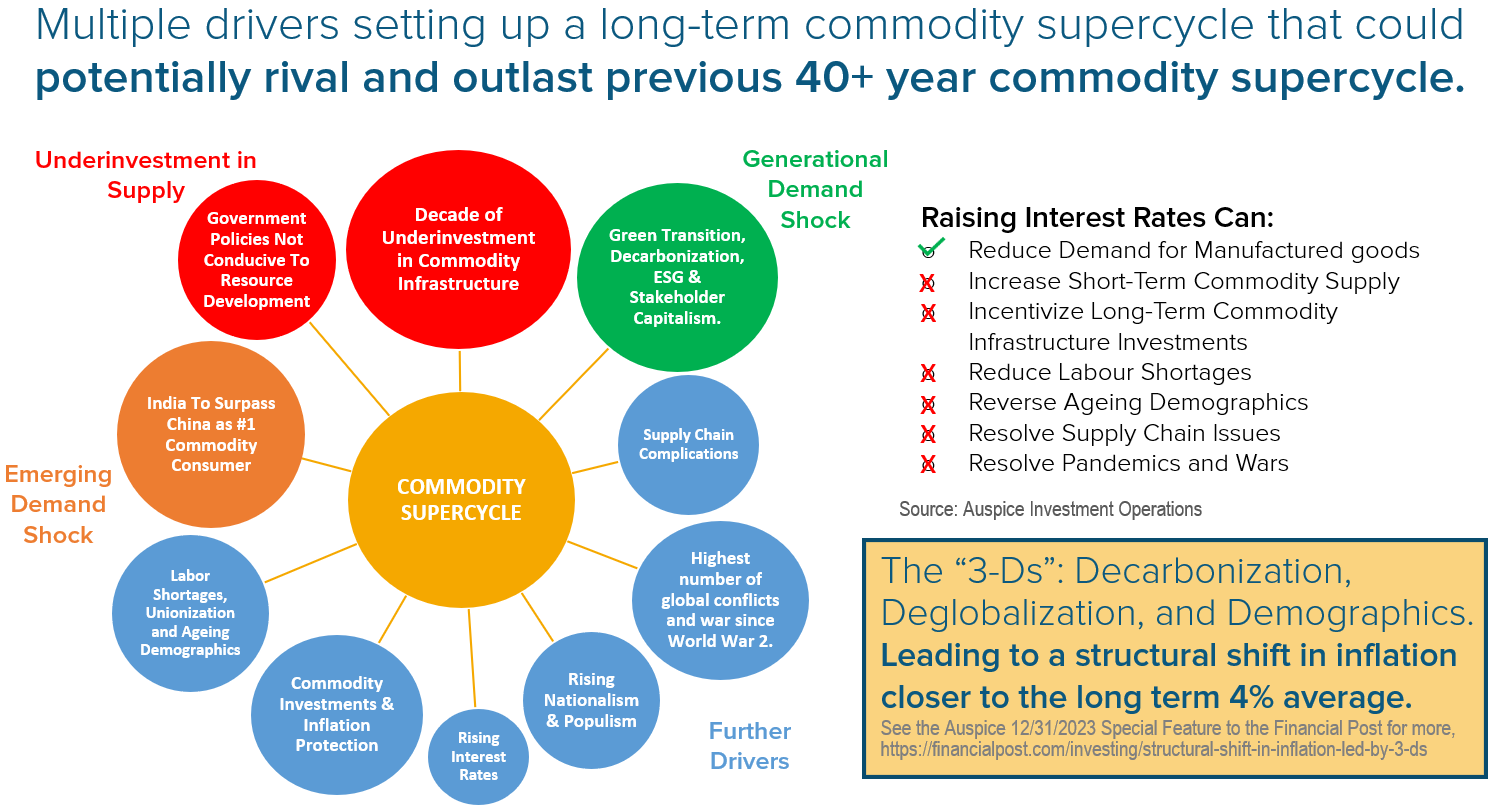

As an example, it is generally understood that central banks raise rates in an attempt to control inflation. Yet what is less understood is that raising rates only affects our spending, the so-called “demand-pull inflation” associated with manufactured goods, whereas it does little to control the “cost-push inflation” associated with commodity prices and wages.

Central banks can't control commodity prices or their supply since raising rates neither increases short-term commodity supplies nor attracts long-term commodity infrastructure investments.

Another rarely made link is the one between technology and commodities, or new school versus old school: the internet, cloud and artificial intelligence (AI) versus picks, shovels and drill bits. But the link is strong and growing stronger, and it may be an important factor in the extension of the current commodity cycle that started in 2020 — cycles that typically last 10 years.

Chart 1 - Goldman Sachs Commodity Index (GSCI) Bull Markets by Decade.

Source: Auspice Capital and Bloomberg as at March 31st, 2024. You cannot invest directly into an index.

The link between commodities and the current tech boom and AI is driven by the demand for data centres, computer chips and electric vehicles (EVs). For each of these technologies to grow, the demand for commodities is massive.

Data centres, power and AI

To borrow a line we couldn't write any better: "Like all technologies known to man, AI has a dark side to it: high energy consumption."

To say that AI is a power hog is an understatement. AI requires more hardware and more powerful chips than typical computing. At 4.3 gigawatts of global power demand today, a figure that could grow almost fivefold by 2028, according to Schneider Electric SE, some argue it already consumes as much power as bitcoin mining.

A single Nvidia Corp. DGX A100 server consumes as much electricity as several U.S. households combined, according to Digiconomist, and cryptocurrencies, blockchains and other technologies all strain data centres.

The demand for space means large data centre operators such as Amazon.com Inc., Microsoft Corp., Alphabet Inc., Meta Platforms Inc., Oracle Corp. and TikTok owner ByteDance are having problems with power supply and "access to electricity is not keeping up," Reuters recently highlighted.

Chips and AI

But it is not just the massive demand for computing power at play since commodities are under increasing pressure, too. There is a link between AI demand and precious metals. "Demand will rise for platinum alloys used in chip manufacturing, silver-palladium ... in high-power components, gold bonding wire in chip and memory packages, gold plating in printed circuit boards and palladium plating on lead frames," Reuters recently reported.

Beyond precious metals, base (industrial) metals are also important. The chips themselves, while commonly known to be silicon-based, require interconnects. These were commonly made from aluminum, but are now typically cobalt or copper. It appears that copper, often used as an economic barometer, is just as important here, too. The highly conductive metal is used to connect components within an integrated circuit in addition to transmitting power to the circuit itself.

We need to recognize the importance of copper in the ever-expanding demand for power by data centres. Electricity grids rely heavily on copper in everything from the turbines that convert mechanical energy into electrical energy to the batteries, wires and transformers that carry that power everywhere. "Our modern world would not function as it does without it," according to a recent article by Business Insider.

Electric vehicles

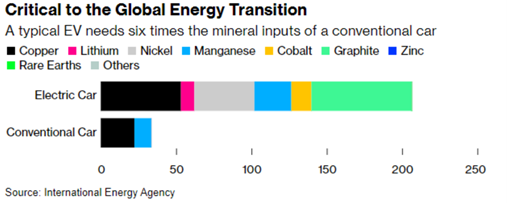

EVs are no doubt part of the future. The rate of adoption is up for debate and seems geographically sensitive, but we can recognize the trade-off. As with everything in life and investing, there is a trade-off: less gasoline demand means power is coming from somewhere else, but the components that facilitate this are still commodity based. The International Energy Agency said the typical EV requires six times the mineral inputs of a conventional car.

Chart 2 – Mineral Requirements of Electric and Conventional Cars

Source: Auspice Capital and Bloomberg as at March 31st, 2024. You cannot invest directly into an index.

As we divert our attention from fossil fuel consumption, there will be a significant impact on demand for lithium, cobalt, graphite for batteries and some less sexy metals such as zinc, nickel and, yes, copper, according to a Deloitte report in 2018 that highlighted some of the expected outcomes:

· Most analysts predicted the global demand for lithium will double or even triple by 2030.

· Analysts predicted the demand for battery-grade graphite will triple by 2020.

· Cobalt was facing a global supply deficit that may grow to 5,340 tons in 2020 from 885 tons in 2018.

· EVs are expected to contain four times as much copper as combustion-powered engines.

· The demand for battery-grade nickel is expected to increase by 50 per cent by 2030.

That’s quite the trade-off.

Commodity cycle

The recent calm in the commodity cycle after the Russia-Ukraine invasion is just a pause. Alongside decarbonization, deglobalization and demographics, inflationary drivers that weren’t present just a few years back, we now have a massive new player in commodity demand — India.

Commodity cycle drivers have never been stronger in history and a new factor such as the tech boom may reawaken the sleeping giant.

Chart 3 – 2020s Commodity Cycle Drivers

Source: Auspice Capital.

It is extremely difficult to time any financial market, but commodity markets are equally challenging. The reality is that commodities are the most diverse asset class — cotton is not like crude is not like coffee is not like canola. Yet all these things are important to our daily lives and economic realities.

None of us know the way an individual technology will play out — how well EVs will be embraced, where AI takes us or if data centres will be driven by cryptocurrency, blockchain or other factors — but we do know that the underlying commodities will be required in some regard, even if it’s just at the breakfast tables of the hoards of people employed by the massive tech world — after all, they gotta eat.

As such, we recommend a diverse broad commodity approach that is systematic and agnostic to a specific market while wrapped in disciplined risk management.

Maybe the greatest trade or investment is indeed a hard one: tech to fuel the next phase of commodity demand. In a way, it seems so obvious: we need energy to power data centres and inputs such as metals. Reuters reported that companies were buying into suppliers to secure deliveries: "Major brands, including the investment arm of the IKEA group, are following automakers' lead in snapping up stakes in suppliers of raw materials and energy, seeking greater control over their production"… "In the past six months, more than $4 billion was spent by firms investing in their supply chains across industries including food, batteries, chemicals, autos, mining, and waste and recycling[1]"

We think big tech may be the next big commodity buyer – at a time when supply is increasingly tight and prices are already on the rise.

If you don’t have a 5-10% allocation to tactical commodity or CTAs strategies, contact us today at info@auspicecapital.com

DEFINITIONS

The S&P Goldman Sachs Commodity Total Return Index (“GSCI TR”) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The S&P GSCI Total Return index measures a fully collateralized commodity futures investment that is rolled forward from the fifth to the ninth business day of each month.

IMPORTANT DISCLAIMERS AND NOTES

Some of the assumptions and opinions contained herein are the view or opinion of the firm and are based on management's analysis of the portfolio performance.

Prior to February 28, 2023, Auspice Diversified Trust was offered via offering memorandum only and this Fund was not a reporting issuer during such prior period. The expenses of the Fund would have been higher during such prior period had the Fund been subject to the additional regulatory requirements applicable to a reporting issuer. Auspice obtained exemptive relief on behalf of the Fund to permit the disclosure of the prior performance data for the Fund for the time period prior to it becoming a reporting issuer.

Commissions, trailing commissions, management fees and expenses may all be associated with investment funds. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

The contents on this website are provided for informational and educational purposes and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting and tax. Please consult with your own professional advisor on your particular circumstances.

Futures trading is speculative and is not suitable for all customers. Past results are not necessarily indicative of future results. This document is for information purposes only and should not be construed as an offer, recommendation or solicitation to conclude a transaction and should not be treated as giving investment advice. Auspice Capital Advisors Ltd. makes no representation or warranty relating to any information herein, which is derived from independent sources. No securities regulatory authority has expressed an opinion about the securities offered herein and it is an offence to claim otherwise. Please read the offering documents before investing.

Certain statements in this document are forward- looking statements, including those identified by the expressions “anticipate”, “believe”, “plan”, “estimate”, “expect”, “intend”, “target”, “seek”, “will” and similar expressions to the extent they relate to the Fund and the Manager. Forward- looking statements are not historical facts but reflect the current expectations of the Fund and the Manager regarding future results or events. Such forward-looking statements reflect the Fund’s and the Manager’s current beliefs and are based on information currently available to them. Forward-looking statements are made with assumptions and involve significant risks and uncertainties. Although the forward-looking statements contained in this document are based upon assumptions that the Fund and the Manager believe to be reasonable, neither the Fund or the Manager can assure investors that actual results will be consistent with these forward-looking statements. As a result, readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results or events to differ materially from current expectations.

The forward-looking statements contained herein were prepared for the purpose of providing prospective investors with general educational background information about the Funds and may not be appropriate for other purposes. Neither the Fund or the Manager assumes any obligation to update or revise them to reflect new events or circumstances, except as required by law.

This blog may contain hypertext links to web sites owned and controlled by other parties than Auspice. We have no control over any third-party-owned web sites or content referred to, accessed by or available on this web site and therefore we do not endorse, sponsor, recommend or otherwise accept any responsibility for such third-party web sites or content or for the availability of such web sites. In particular, we do not accept any liability arising out of any allegation that any third-party-owned content (whether published on this or any other web site) infringes the intellectual property rights of any person, or any liability arising out of any information or opinion contained on such third-party web site or content

[1] https://www.reuters.com/sustainability/companies-buy-into-suppliers-secure-deliveries-hit-green-targets-2023-07-21/